Red Sea Crisis: A New Threat to Global Inflation and Supply Chains

The Red Sea crisis, a geopolitical hotspot of profound significance, unfolds along one of the world’s busiest maritime routes, linking Europe, Asia, and Africa.

The strategic waterway, flanked by nations with diverse political interests, has witnessed escalating tensions, heightened by regional rivalries, global political turmoil, maritime disputes, and geopolitical power plays.

The confluence of economic interests, security concerns, and historical animosities has transformed the Red Sea into a crucible of international contention.

Table of Contents

Red Sea Crisis

As global powers navigate the complex dynamics surrounding this vital maritime artery, the Red Sea crisis stands as a testament to the intricate interplay of politics, commerce, and security in a critical geopolitical theater.

The Red Sea crisis has emerged as a potent threat to global economic stability, potentially impacting inflation rates and disrupting crucial supply chains. This maritime crisis, with its roots in geopolitical tensions, poses challenges to the movement of goods through one of the world’s busiest waterways, contributing to global economic instability.

In this article, we delve into the Red Sea crisis, exploring its origins, potential ramifications, and the implications for global inflation and supply chains.

1. Geopolitical Tensions and the Red Sea

Ongoing attacks on ships in the Red Sea, attributed to Iran-backed Houthi militants in Yemen, have led to a significant impact on global trade. With over $200 billion diverted from the crucial

Middle East route, connecting the Mediterranean to the Indian Ocean, freight rates are soaring, causing concerns about inflation and delayed goods. The strategic Red Sea corridor, vital for Europe, Asia, and Africa, faces heightened geopolitical tensions due to conflicts like the Yemeni Civil War.

Security issues in the region, coupled with diversions and longer shipping times, create a multifaceted challenge for logistics managers, threatening the timely arrival of spring and summer products.

2. Chokepoint Vulnerability and Global Trade

The Bab el-Mandeb strait, a vital maritime passage, facilitates the daily transit of millions of barrels of oil and commodities, with 2023 recording 9.4 million barrels per day, constituting almost 10% of global seaborne oil trade.

Any disruption in this strategic chokepoint can have far-reaching consequences on worldwide trade. Recognizing its vulnerability highlights the imperative to address geopolitical tensions in the region, safeguarding the uninterrupted flow of goods.

Efforts to mitigate risks in the Bab el-Mandeb strait are crucial for maintaining global economic stability and energy security, underscoring the need for diplomatic solutions and international cooperation.

3. Impact on Energy Prices

The Red Sea plays a crucial role in global energy dynamics, with its transportation of a substantial oil volume. Disruptions in this region, particularly at the Bab el-Mandeb strait, exert immediate influence on worldwide energy prices.

A decrease in oil flow through this passage can instigate supply shortages, prompting a surge in oil prices. This escalation ripples into global inflationary pressures, impacting both consumers and industries.

The International Energy Agency (IEA) warns that a mere 10% reduction in Red Sea oil supply could yield a staggering 25% hike in oil prices, carrying profound consequences for economies and businesses heavily reliant on energy resources.

The interconnectedness of these factors underscores the critical importance of stable maritime routes for global energy security.

4. Supply Chain Disruptions

The Red Sea crisis presents on of the biggest challenge to global supply chains, particularly reliant on seamless maritime transportation. The threat encompasses shipping delays, heightened insurance expenses, and potential rerouting, jeopardizing the prompt conveyance of vital resources and finished goods.

This upheaval may trigger inventory deficiencies, production deceleration, and elevated operational expenses, impacting diverse industries worldwide.

As the crisis unfolds, businesses must navigate these complications, adapting strategies to mitigate risks and sustain operational resilience in the face of mounting challenges to international trade and commerce.

5. Increased Costs for Shipping and Insurance

The global shipping industry faces challenges as approximately 20% of vessel capacity remains unused due to a sharp decline in manufacturing orders, leading ocean carriers to reduce sailings. This, combined with tight capacity and prolonged travel times, contributes to escalating freight rates.

Rates for cargo from Asia to northern Europe have more than doubled, exceeding $4,000 per 40-foot-equivalent unit, while Asia-Mediterranean prices reached $5,175 per container. Some carriers propose rates surpassing $6,000 per 40-foot container for Mediterranean shipments, accompanied by surcharges ranging from $500 to $2,700 per container.

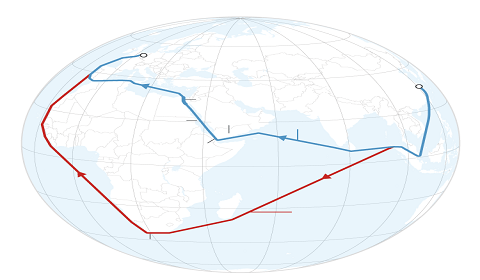

- Note: These times assume an average vessel speed of 16 knots. Routes shown are illustrative.

- Source: Flexport

- Graphic: Lou Robinson, CNN

Heightened tensions in the Red Sea region amplify shipping and insurance costs, prompting companies to adjust routes, increasing operational expenses.

The Baltic Dry Index reflects uncertainties, and rates from Asia to North America’s East Coast have surged 55% to $3,900 per container, with West Coast prices rising 63% to over $2,700. Shippers may increasingly favor West Coast ports, anticipating further rate hikes starting January 15.

6. Global Inflationary Pressures

The Red Sea crisis, if prolonged, could disrupt global energy supplies and supply chains, leading to a potential 1.5% increase in global inflation, as per the World Bank. Economists at Allianz Trade suggest that a doubling of shipping costs might elevate inflation by 0.7 percentage points for Europe and the US, impacting the world by an additional 0.5 percentage points.

Oxford Economics estimates a permanent $10 rise in oil prices could contribute 0.22 percentage points to UK inflation and 0.29 points globally in 2024. This situation could also contract global output by 0.07% this year, with the UK alone experiencing a 0.09% reduction.

7. Diplomatic Solutions and Future Outlook

Addressing the Red Sea crisis requires diplomatic efforts to de-escalate tensions and establish a framework for secure maritime passage. International cooperation is crucial to ensure the stability of this vital trade route.

The United Nations, regional organizations, and key stakeholders must collaborate to find diplomatic solutions that safeguard global economic interests.

Bottom Line

The Red Sea crisis presents a multifaceted challenge, intertwining geopolitical tensions, energy security, and global supply chains. The potential ramifications on inflation rates and supply chain disruptions necessitate a coordinated and diplomatic approach to resolve the underlying issues.

As the world navigates through these challenges, it is imperative for nations to prioritize stability in the Red Sea region for the collective benefit of the global economy.